Session 2

Trading and Markets & Floor and Limit Order Markets

Preview of Activities

Quiz

This assessment will count towards your individual participation grade.Trading and Markets

The Need for Trade and Markets - Dr. Riordan

Trading and Markets: Mandatory Readings

Please read the following articles. As you're reading, consider the need for trade, how trade leads to specialization, and why markets were formed.

Why Do Countries Trade?

Economics Online. (n.d.). Why Do Countries Trade? Retrieved on September 5, 2020 from https://www.economicsonline.co.uk/Global_economics/Why_do_countries_trade.html

The Importance of International Trade

Pettinger, T. (2019, March 26). The Importance of International Trade. Retrieved on September 5, 2020 from https://www.economicshelp.org/blog/58802/trade/the-importance-of-international-trade/

Benefits of Free Trade

Pettinger, T. (2019, July 28). Benefits of Free Trade. Retrieved on September 5, 2020 from https://www.economicshelp.org/trade2/benefits_free_trade/

Arguments Against Free Trade

Pettinger, T. (2018, November 28). Arguments Against Free Trade. Retrieved on September 5, 2020 from https://www.economicshelp.org/trade2/arguments-against-free-trade/

Market Economy, Its Characteristics, Pros, and Cons, with Examples

Amadeo, K. (2020, April 6). Market Economy, Its Characteristics, Pros, and Cons, with Examples. Retrieved on September 5, 2020 from https://www.thebalance.com/market-economy-characteristics-examples-pros-cons-3305586

Financial Markets

Financial Markets - Dr. Riordan

Financial Markets: Mandatory Readings

Please read the following articles and watch the TED-Ed talk by Oliver Elfenbaum.What are financial markets and why are they important?

Bank of England. (n.d.). What are financial markets and why are they important? Retrieved on September 5, 2020 from https://www.bankofengland.co.uk/knowledgebank/what-are-financial-markets-and-why-are-they-important

Please explain how financial markets may affect economic performance.

Federal Reserve Bank of San Francisco. (2005, January). Please explain how financial markets may affect economic performance. Retrieved on September 5, 2020 from https://www.frbsf.org/education/publications/doctor-econ/2005/january/financial-markets-economic-performance/

The Social Functions of the Stock Market: A Primer

Fox, M. (2019, April 12). The Social Functions of the Stock Market: A Primer Retrieved on September 5, 2020 from https://clsbluesky.law.columbia.edu/2019/04/12/the-social-functions-of-the-stock-market-a-primer/

How does the stock market work? - Oliver Elfenbaum

Trading and Markets: Optional Readings

Chapter 7: Foreign Exchange and the Global Capital Markets

International Business, adapted by Saylor Academy. (n.d.). Chapter 7: Foreign Exchange and the Global Capital Markets. Retrieved on September 5, 2020 from https://saylordotorg.github.io/text_international-business/s11-foreign-exchange-and-the-globa.html

Floor and Limit Order Markets

How does an order book present information?

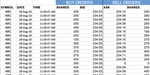

A limit order book is a record of incoming orders, both to buy and sell shares of stocks. Orders to sell are referred to as offers. Orders to buy are referred to as bids. Below, you will find a guide on how to record order book transactions in Excel.

Tracking Incoming Orders

In the limit order books you will be viewing and constructing in this course, bids will be found on the left side, and offers will be found on the right side. Bids and offers enter the order book at the time the order is made. Therefore, a bid may arrive before an executable offer is available.

Example:

Price

Price

New orders enter the order book in terms of price. The highest priced bids are entered at the top of each column. Thus, bids and offers are in price order top to bottom.

Bids at the top of the bids columns execute against offers at the bottom of the offers columns.

TimeYou may notice that the order book example above does not have timestamps. In this current view, we must assume that the bid for 200 shares at $9.98 could be from multiple traders. For example, it is possible that the first 100 shares at $9.98 came from Trader A and the second 100 shares at $9.98 came from Trader B.

Generally, order books choose to display this time-sensitive data in different ways. An effective order book coordinates with the software and algorithms you are using and is important to keep up with high-speed trading. For most purposes, when you are submitting an order that will execute immediately, it is unimportant how many traders are behind a buy or sell order resting in the limit order book. For those traders that submitted the orders it is important to know if you are the first, or second, or third, … to execute. For instance, if there are 5 other traders with orders ahead of you at a certain price, you may decide to submit a new order at a better price, to move to the top of the queue at that new price or even execute against an order on the other side of the order book.

Top-of-Book OrdersThe highest priced bid is considered the “top-of-book order.” Therefore, in the example above, the top-of-book bid is 9.98.

On the other hand, the lowest priced offer is considered the top-of-book order. Therefore, in the example above, the top-of-book offer is for 10.01.

The top-of-book orders are also called the best prices.

Floor Markets: Mandatory Readings

Trading Floor - A Guide to Jobs and Work on the Trading Floor

Corporate Finance Institute. (n.d.). Trading Floor - A Guide to Jobs and Work on the Trading Floor. Retrieved July 13, 2020, from https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/trading-floor/

Floor Markets - Dr. Riordan

Limit Order Markets - Dr. Riordan

Rules of Priority - Dr. Riordan

Marketable Limit Orders - Dr. Riordan

So far, we have looked at how individual orders operate within one market. However, multiple markets exist for trading the same asset. These multiple markets lead to what is called “fragmented markets." Each market operates with slightly different order priorities and rules of trading, consequently, making trade more complicated. Orders that may execute first in one market may not execute at all in another market. Understanding these rules of execution priority and making decisions about which market is the best for a given order is an important part of trading in fragmented markets. The next video will illustrate how multiple markets have an effect on calculating execution prices.

Introduction to Multiple Markets - Dr. Riordan

Calculating Execution Prices

What does it mean to calculate the execution price?

Throughout the rest of this course, you will sometimes be asked to “calculate the execution price” of a bid or offer. This means that you should delete any transacting bids and offers from the order book and then list any order that transacts in the sequence in which they execute. You should include how many shares and at what price. See the example below.

Example:

This example has some orders that would transact and therefore, it is not an authentic view of an order book because those transactable orders would immediately execute and be deleted from the order book.

For example:“The bid for 200 shares at $5.18 would immediately transact with the offer for 100 shares at $5.07. That offer would be completely fulfilled and would immediately disappear. There would be 100 shares of the bid at $5.18 remaining.

Then, the remaining 100 shares of the bid for 200 shares at $5.18 that did not previously transact would execute against the next top-of-book offer for 150 shares at $5.12.”

The resulting order book after the transaction would look like this:

Floor and Limit Order Markets: Exercises

Exercise 1

Q1: Imagine an Offer

Q1: Imagine an Offer

Given the above order book, provide an example of an offer that would make one or more bids execute. For example, “An order to sell X shares at $Y arrives.”

Q2: Calculate the Execution Price(s)

Using your imagined offer, explain which bid or bids execute and the execution price. Review Calculating Execution Prices if necessary.

For example, “The bid for X shares at $Y would immediately transact with the offer for A shares at $B and both bid and offer would immediately disappear.”

Q3: Analyze the Effect of Fragmented MarketsYou should now have a better sense of order book operations. Remember that there are multiple markets, each with their own priorities and rules. In your opinion, what kind of problems can occur when multiple markets each have their own variations of price-time-visibility rules? How might those different priorities and rules affect the construction of a limit order book?

Exercise 2

Imagine a new order to buy 200 shares at $10.00 arrives. Where does it enter the order book?

1. Position A (top of bid column)2. Position B (bottom of bid column)

3. Position C (top of offer column)

4. Position D (bottom of offer column)

In the above order book, which order is considered the top-of-book offer?

1. order to sell 50 shares at $10.032. order to sell 800 shares at $10.07

3. order to sell 100 shares at $10.01

4. order to buy 100 shares at $9.98