.js-id-readings11bd

CBOE dives into Canadian dark pool trading with acquisition

Ed Tilly, president and CEO of CBOE Global Markets, discusses the acquisition of Canadian alternative trading system MatchNow, which is the largest provider of dark pool trading in the country.

n.d., BNN Bloomberg

n.d., BNN Bloomberg

Dark Pool Trading System & Regulation

The effective regulation of “dark pools”, which are private forums for trading securities, is necessary to secure efficient trade execution, and to ensure transparent and fair markets as a means of fostering confidence and trust in trading markets.

n.d., CFA Institute

n.d., CFA Institute

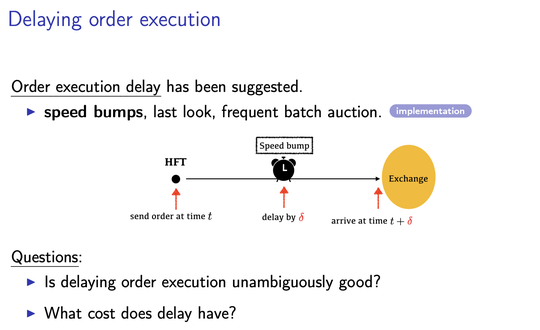

Dark Side of Delaying Order Execution

High-frequency trading (HFT) firms provide and take liquidity using speed and superior information.

Sep 30, 2020, Jun Aoyagi

Sep 30, 2020, Jun Aoyagi

2010 Flash Crash

The May 6, 2010 flash crash was a United States trillion-dollar stock market crash, which started at 2:32 p.m. EDT and lasted for approximately 36 minutes.

Sep 26, 2020, Various Authors

Sep 26, 2020, Various Authors

Big Data in Finance

Big data in finance refers to large, diverse (structured and unstructured) and complex sets of data that can be used to provide solutions to long-standing business challenges for financial services and banking companies around the world.

n.d., Corporate Finance Institute

n.d., Corporate Finance Institute

Big data in finance and the growth of large firms

Two modern economic trends are the increase in firm size and advances in information technology. We explore the hypothesis that big data disproportionately benefits big firms.

August 2018, Begenau, Farboodi & Veldkamp

August 2018, Begenau, Farboodi & Veldkamp

Blockchain disruption and decentralized finance - The rise of decentralized business models

Blockchain technology can reduce transaction costs, generate distributed trust, and empower decentralized platforms, potentially becoming a new foundation for decentralized business models.

June 2020, Yan Chen & Cristiano Bellavitis

June 2020, Yan Chen & Cristiano Bellavitis

Does a Central Clearing Counterparty Reduce Counterparty Risk?

We show whether central clearing of a particular class of derivatives lowers counterparty risk. For plausible cases, adding a central clearing counterparty (CCP) for a class of derivatives such as credit default swaps reduces netting efficiency, leading to an increase in average exposure to counterparty default.

July 18, 2011, Darrell Duffie & Haoxiang Zhu

July 18, 2011, Darrell Duffie & Haoxiang Zhu

Flash Crash — the trading savant who crashed the US stock market

Liam Vaughan’s account of maths prodigy Navinder Sarao is a cautionary tale on modern finance.

May 7, 2020, Katie Martin

May 7, 2020, Katie Martin

Is Bitcoin a Real Currency? An economic appraisal

A bona fide currency functions as a medium of exchange, a store of value, and a unit of account, but bitcoin largely fails to satisfy these criteria.

April, 2014, David Yermack

April, 2014, David Yermack

Laura Veldkamp on Modeling and Measuring the Data Economy

The five largest American companies derive most of their value not from physical assets, but from intangibles ones, like data. Data and new data technologies are changing production, labor and valuation.

April 2020, Veldkamp

April 2020, Veldkamp

Long Run Growth of Financial Data Technology

“Big data” financial technology raises concerns about market inefficiency. A common concern is that the technology might induce traders to extract others’ information, rather than to produce information themselves.

October 2019, Farboodi & Veldkamp

October 2019, Farboodi & Veldkamp

Market Design with Blockchain Technology

Blockchain or, more generally, distributed ledger technology allows to create a decentralized digital ledger of transactions and to share it among a network of computers.

July 26, 2017, Katya Malinova & Andreas Park

July 26, 2017, Katya Malinova & Andreas Park

Smart Settlement

Recent regulatory and FinTech initiatives aim to streamline post-trade infrastructures. Does faster settlement benefit markets?

May 1, 2018, Mariana Khapko & Marius Zoican

May 1, 2018, Mariana Khapko & Marius Zoican

Some Simple Economics of the Blockchain

We build on economic theory to discuss how blockchain technology can shape innovation and competition in digital platforms.

April 20, 2019, Christian Catalini & Joshua S. Gans

April 20, 2019, Christian Catalini & Joshua S. Gans

The Economics of Cryptocurrencies – Bitcoin and Beyond

How well can a cryptocurrency serve as a means of payment? We study the optimal design of cryptocurrencies and assess quantitatively how well such currencies can support bilateral trade.

September 1, 2017, Jonathan Chiu & Thorsten V. Koeppl

September 1, 2017, Jonathan Chiu & Thorsten V. Koeppl

Why finance is deploying natural language processing

Big data in finance refers to large, diverse (structured and unstructured) and complex sets of data that can be used to provide solutions to long-standing business challenges for financial services and banking companies around the world.

Nov 3, 2020, Tracy Mayor

Nov 3, 2020, Tracy Mayor

Chapter 19 - Performance Evaluation

Read pages 176 - 188; review the examples, but you may skip over the exhibits.

Key topics - risk and return, expected return, market risk, Sharpe ratio

2014, Andrew Clare

Key topics - risk and return, expected return, market risk, Sharpe ratio

2014, Andrew Clare

FCA researchers outline $5bn ‘tax’ imposed by high-speed trading

Paper released by UK regulators homes in on tactic known as latency arbitrage.

Jan 27, 2020, Philip Stafford

Jan 27, 2020, Philip Stafford

Interpreting Factor Models

Optional reading.

2017, Kozak, Nagel and Santosh

2017, Kozak, Nagel and Santosh

Modern Portfolio Theory and Investment Analysis, 9e - Chapter 16

Read pages 385 - 394.

Key topics - passive/active investing, factor investing, statistical models

2014, Edwin Elton, Stephen Brown, William Goetzmann & Martin Gruber

Key topics - passive/active investing, factor investing, statistical models

2014, Edwin Elton, Stephen Brown, William Goetzmann & Martin Gruber

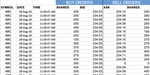

The Capital Asset Pricing Model - Theory and Evidence

Read pages 25 - 30.

Key topics - CAPM

2004, Eugene Fama and Kenneth French

Key topics - CAPM

2004, Eugene Fama and Kenneth French

The Economics of Complex Decision Making - The Emergence of the Robo Adviser

Please review the full text.

2017, Fisch, Laboure & Turner

2017, Fisch, Laboure & Turner

Pre-Course Survey (Section 1)

Please complete this survey if you are enrolled in Section 1.

Pre-Course Survey (Section 2)

Please complete this survey if you are enrolled in Section 2.

Quick Tips for Online Learning Success

Whether you are a remote-learning veteran or are taking a course for the first time, the following tips will help to make your experience as meaningful as possible.

Session 1 - Introduction to Course

Welcome to MFIN841!

Session 10 Quiz

This quiz will count towards your individual participation grade. Ensure you have completed all mandatory readings before starting the quiz (they will be tested). Please note that these quizzes are being assessed on a participation basis only; full marks will be given to those that complete the quiz (scores will not affect the participation grade).

Session 11 Quiz

This quiz will count towards your individual participation grade. Ensure you have completed all mandatory readings before starting the quiz (they will be tested). Please note that these quizzes are being assessed on a participation basis only; full marks will be given to those that complete the quiz (scores will not affect the participation grade).

Session 2 Quiz

This quiz will count towards your individual participation grade. Ensure you have completed all mandatory readings before starting the quiz. Only entries submitted prior to the beginning of next class will be accepted. Please note that these quizzes are being assessed on a participation basis only; full marks will be given to those that complete the quiz (scores will not affect the participation grade).

Session 3 Quiz

This quiz will count towards your individual participation grade. Ensure you have completed all mandatory readings before starting the quiz. Only entries submitted prior to the beginning of next class will be accepted. Please note that these quizzes are being assessed on a participation basis only; full marks will be given to those that complete the quiz (scores will not affect the participation grade).

Session 4 Quiz

This quiz will count towards your individual participation grade. Ensure you have completed all mandatory readings before starting the quiz (they will be tested). Only entries submitted prior to the beginning of next class will be accepted. Please note that these quizzes are being assessed on a participation basis only; full marks will be given to those that complete the quiz (scores will not affect the participation grade).

Session 5 Quiz

This quiz will count towards your individual participation grade. Ensure you have completed all mandatory readings before starting the quiz (they will be tested). Only entries submitted prior to the beginning of next class will be accepted. Please note that these quizzes are being assessed on a participation basis only; full marks will be given to those that complete the quiz (scores will not affect the participation grade).

Session 6 Quiz

This quiz will count towards your individual participation grade. Ensure you have completed all mandatory readings before starting the quiz (they will be tested). Only entries submitted prior to the beginning of next class will be accepted. Please note that these quizzes are being assessed on a participation basis only; full marks will be given to those that complete the quiz (scores will not affect the participation grade).

Session 8 Quiz

This quiz will count towards your individual participation grade. Ensure you have completed all mandatory readings before starting the quiz (they will be tested). Only entries submitted prior to the beginning of next class will be accepted. Please note that these quizzes are being assessed on a participation basis only; full marks will be given to those that complete the quiz (scores will not affect the participation grade).

Session 9 Quiz

This quiz will count towards your individual participation grade. Ensure you have completed all mandatory readings before starting the quiz (they will be tested). Only entries submitted prior to the beginning of next class will be accepted. Please note that these quizzes are being assessed on a participation basis only; full marks will be given to those that complete the quiz (scores will not affect the participation grade).

Paying for Speed- Are Traders Wasting Money?

For a price, high-speed traders can plug into a stock market’s backbone. Unfair advantage or fair exchange?

Mar 8, 2016, Anna Sharratt

Mar 8, 2016, Anna Sharratt

Robot Auction Bidders Are Such Buzzkills

Competing against automated agents induces auction bidders to skip risky behaviour.

Oct 21, 2015, Kenza Moller

Oct 21, 2015, Kenza Moller

Making Sense of the Fast — and the Furious

Is high-frequency trading the most evil finance scheme ever conceived? Ryan Riordan crunches some hard-to-access data and comes away with a reassuring tale.

Sep 23, 2014, Anna Sharratt

Sep 23, 2014, Anna Sharratt

Money & Speed- Inside the Black Box (Optional)

Optional (long, but worth watching if you have time) - Based on interviews with those directly involved and data visualizations up to the millisecond, it reconstructs the flash crash of May 6th 2010.

Dec 13, 2012, VPRO

Dec 13, 2012, VPRO